FundBox Review

OUR SCORE 80%

OUR SCORE 80%

- What is FundBox

- Product Quality Score

- Main Features

- List of Benefits

- Technical Specifications

- Available Integrations

- Customer Support

- Pricing Plans

- Other Popular Software Reviews

What is FundBox ?

Fundbox is accounting software designed by a small business composed of financial professionals and technological innovators. They built the platform to help other small-scale businesses to become more independent and grow. The software provides users with a simple way to manage their business cash flow by advancing payments for any outstanding invoices. The tool is also usable by freelancers, sole proprietors, and medium-sized enterprises. If you are one of them and are providing services to individuals or another company and usually issues invoices to get payment, this platform is worth trying.Product Quality Score

FundBox features

Main features of FundBox are:

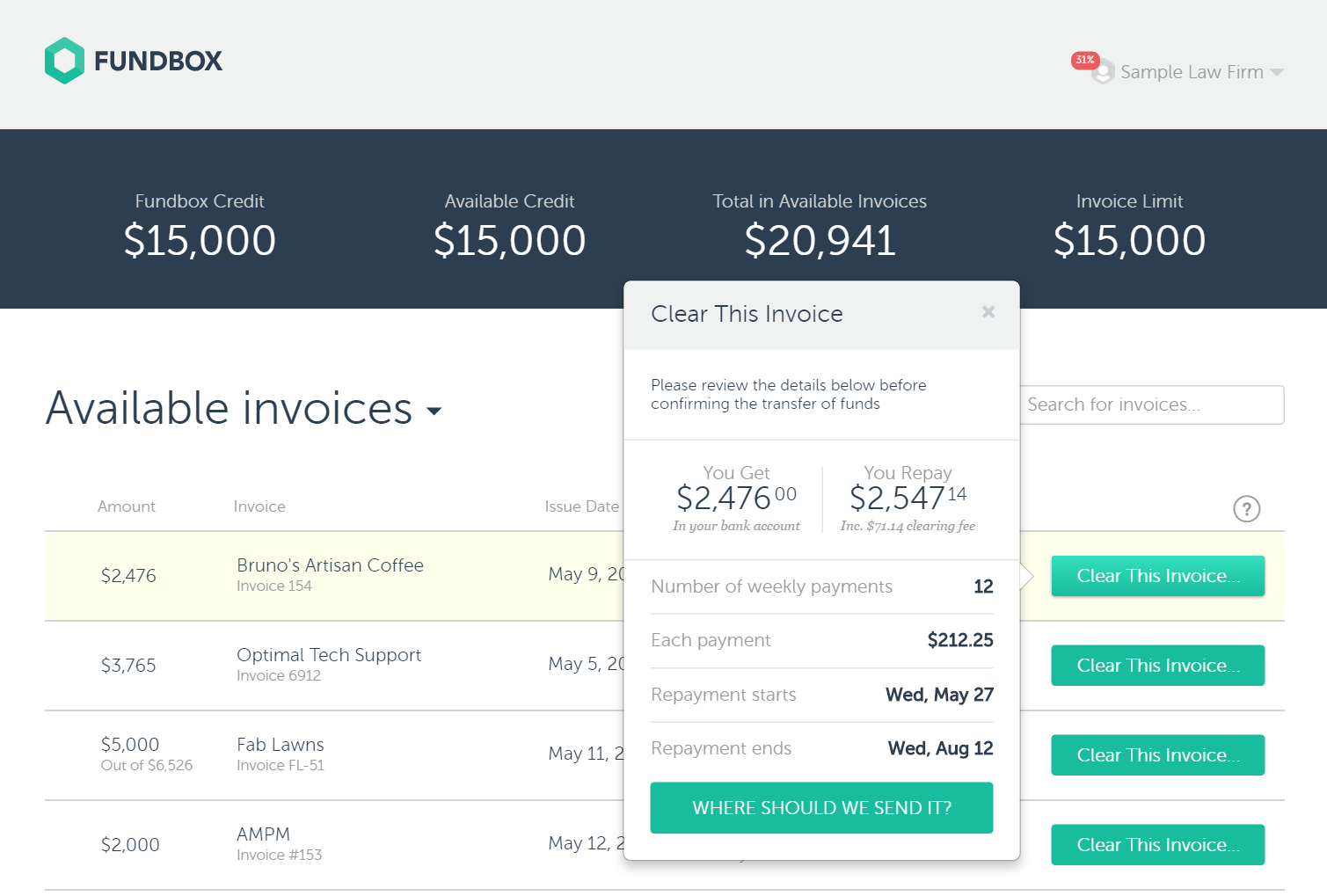

- Invoice dashboard

- Fees management

- Cash flow management

- Clear invoices

- No setup fees

- No subscription fees

- Fully online

- Automated funding

- No early repayment fees

- Integration

FundBox Benefits

The main benefits of Fundbox are its capability to make cash flow management easier, its assistance of payment advances to businesses, the fast and easy registration process, and platform reliability. Here are more details:

Cash Flow Management Made Easier

With Fundbox, managing your business cash flow becomes easier. The platform offers advance payments for your invoices and eliminates business cash flow gaps by clearing invoices immediately. The software is also advancing a significant amount of invoices per week, giving users the capacity to optimize cash flow and removing the net 90, 60, and 30-day common problem of small business.

Get Advance Payments

When it comes to running a business, keeping a seamless and constant cash flow is essential to survive particularly during the first years of the business. To keep the cash flowing, you will need to wait for the payment from your customers. But with Fundbox, you do not need to wait for your clients or customers to pay, as you can collect payment advance based on the outstanding invoices.

Fast and Easy Registration Process

Getting started with the system is pretty easy and fast. It takes less than thirty seconds to register. There are no documents to be submitted. Once you are registered, the system will connect you to the bookkeeping app of the company and gather all your unpaid invoices. You can instantly receive the funds into your bank account.

Reliable Platform

Fundbox has been trusted by more than 100,000 industry experts and businesses. The significant amount of users show how effective is. Also, the system uses the best practice security protocols in the industry so you are sure that payments and crucial pieces of information are safe and protected.

Technical Specifications

Devices Supported

- Web-based

- iOS

- Android

- Desktop

Customer types

- Small business

- Medium business

- Enterprise

Support Types

- Phone

- Online

FundBox Integrations

The following FundBox integrations are currently offered by the vendor:

- Xero

- FreshBooks

- Harvest

- QuickBooks Online

Video

Customer Support

Pricing Plans

FundBox pricing is available in the following plans: