Curexe Review

OUR SCORE 80%

OUR SCORE 80%

- What is Curexe

- Product Quality Score

- Main Features

- List of Benefits

- Technical Specifications

- Available Integrations

- Customer Support

- Pricing Plans

- Other Popular Software Reviews

What is Curexe?

Curexe is an online money transfer application that aims to aid people and businesses to pay for products and services purchased and to send wages to staffs. It is a more affordable alternative to typical and other widely known payment channels and services like money remittances (Xoom, Western Union, etc.), PayPal, bank transfers, and others. The average online payment and bank transfer channels charge a 3.64% bank fee and $35 to $50 wire fee. And those who choose to transfer money physically using the over-the-counter method would be required to spend some money on the trip and even on inter-branch transactions. Curexe addresses this by asking users the lowest fee for online payments and foreign currency exchanges. There are no hidden charges as well on top of having no large processing or transaction fees.Product Quality Score

Curexe features

Main features of Curexe are:

- Transfer Funds

- Online Money Transfer

- Currency Exchange

- Data Encryption Security

- CDIC Insured

- Multi-Currency Invoicing

Curexe Benefits

The main benefits of Curexe are it allows users to save lots of money by being a cost-effective and cheap payment gateway, it is secure, and its high availability. Here are more details:

Cost-effective

While the advent of bank transfers and online payment channels made the purchasing of products and paying for services a lot faster and easier, it comes with a cost. Curexe is addressing this issue by providing users with a platform for online payment and currency exchange that will allow them to save more money than other similar platforms for every transaction they make.

Economical

Curexe only requires 2% for online banking for invoice payments, 1% fee for foreign currency exchanges, and no charge for wire transfers. Comparing this to the rate mentioned earlier, users are treated with a bargain every time they use Curexe for payment transfer. There are no hidden fees or wire transactions piling up. Every process is done online as well, meaning users are able to save transport cost too.

Secured

Curexe doesn’t only provide money-saving features but tight security as well. Through CDIC (Canada Deposit Insurance Corporation), every cent involved in a transaction is safe and insured. All information after signing up is protected as well through a highly secure data encryption method.

High availability

From 9 pm EST Sunday up to 4 pm EST Friday, currency exchange or money transfer is available for 24 hours every day. The entire process takes a mere 30 seconds for funds transfer, saving users some time as well.

Technical Specifications

Devices Supported

- Web-based

- iOS

- Android

- Desktop

Customer types

- Small business

- Medium business

- Enterprise

Support Types

- Phone

- Online

Curexe Integrations

The following Curexe integrations are currently offered by the vendor:

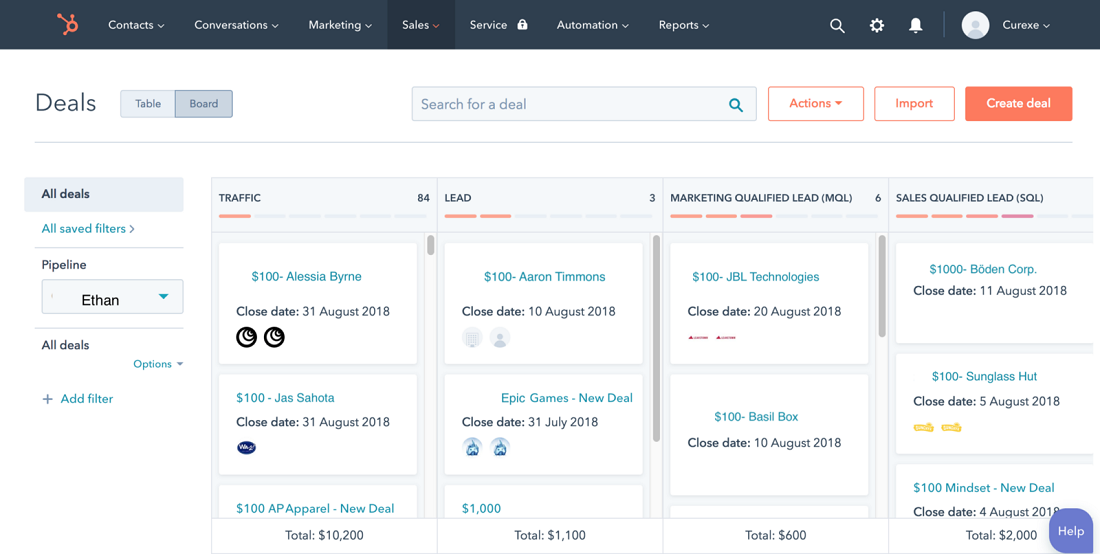

- HubSpot

- HelloSign

Video

Customer Support

Pricing Plans

Curexe pricing is available in the following plans: