You have an online shop, but you do not have a good payment processor that can accept different payment methods and currencies, making customers abandon carts. This is a huge problem because your revenue takes a bad hit. And if this continues, you may have to close shop.

Since you’re here, you may have realized that the solution to your problem is a reliable payment gateway software. And you must be narrowing down your list and are ready to make a decision. That is why we prepared this comparison of two of the renowned names in payment processing: 2Checkout and Stripe.

2Checkout

2Checkout is considered as one of the leading payment gateway software around that is a good partner if your business is global or is considering going worldwide as it supports languages like Spanish, French, and Dutch.

It is also designed for ecommerce so you can expect it to work with a wide array of payment methods. You can accept payments via bank transfer, Apple Pay, Family Dollar, 7-Eleven, and more. When it comes to currencies, it supports USD, CAD, DOP, MXN, and EUR, to name a few.

Moreover, with 2Checkout, you can find tools for creating or integrating with an ecommerce site. Thus, you can process payments locally and make the entire process seamless for your customers.

Stripe

Stripe is among the popular payment processing solutions available today. Apart from that, it also serves as a payment gateway and as a solution that supports the point-of-sale software operations. What’s more, it has additional functions that make it a robust platform.

You may need a little technical knowledge to make the most out of Stripe. Nevertheless, when you do, you can tap its advanced capabilities and leverage them for your business.

Stripe also takes your business to the global stage. That is because the platform can process transactions in more than 135 currencies. Other than that, the solution has local services, such as VAT and sales tax processing. You can check out our Stripe vs Adyen comparison guide to expand your options.

Comparing 2Checkout vs. Stripe

This 2Checkout vs. Stripe comparison will run for four rounds. We will take a look at their features, such as support for cross-border transactions and multi-currency management. At the same time, we will check their integrations, especially with ecommerce solutions and the best shopping cart software.

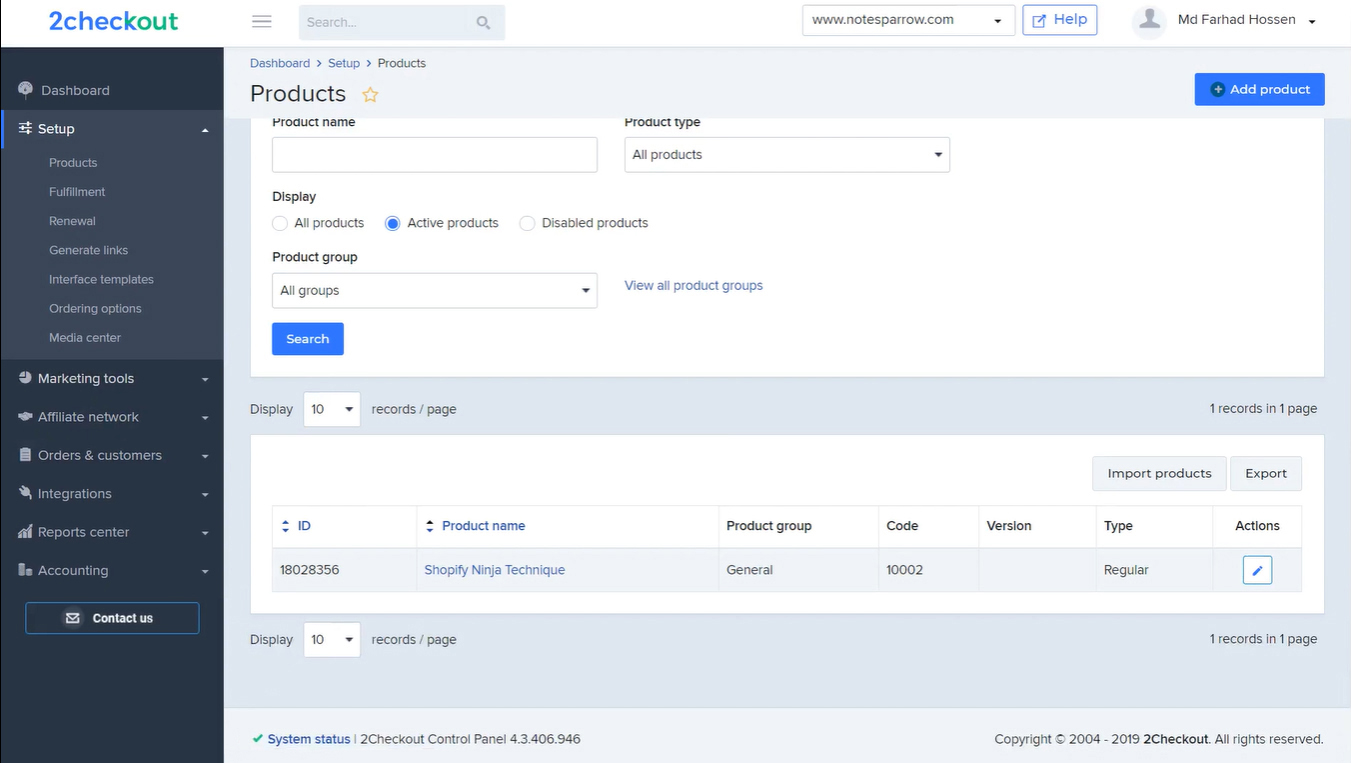

2Checkout’s product listing dashboard shows how this app is primed for ecommerce.

Second, we will see whether it is easy to use the two payment processing solutions we examine here. After all, regardless of how great its capabilities are, it will not be used unless it is intuitive and user-friendly.

The third thing we will deal with is the fees. Of course, it cannot be avoided. But which of the two has the most economical enterprise pricing?

Lastly, we will determine if they have the necessary measures to protect customer data and to prevent fraud.

Continue below for our full 2Checkout vs. Stripe comparison.

1. Payment Processing Features

For the first round, we will look at the features of 2Checkout and Stripe. We will especially investigate how they can take your business to the global scene with their payment processing capabilities. Plus, we will identify which currencies they support.

2Checkout

2Checkout has what it calls intelligent payment routing. This means that cross-border transactions have higher chances of getting through. This is especially important if you have clients in countries located across different continents.

In relation to that, the platform offers multi-currency management. If you are going international, you need to assure customers that they can pay in the currencies available to them. In this way, you can reduce cart abandonment and give buyers an elevated online shopping experience.

The solution can also accept over 45 payment methods. The list varies from region to region, but you can expect to transact through bank transfer, Visa, Mastercard, PayPal, Neteller, and Apple Pay.

For currencies, 2Checkout supports 100 display and billing currencies. Aside from the usual list of common currencies, it works with NOK, SEK, CNY, HKD, JPY, ZAR, and more.

When it comes to integrations, 2Checkout has a wide array. Among the shopping cart platforms that it can connect with include Magento, Drupal, Shopify, and WooCommerce.

Stripe

It is a no-brainer that Stripe enables businesses to go global. It is a solution that helps you overcome challenges so that you can sell your goods to customers wherever they are.

Stripe also has a long list of payment methods it supports. Of course, it can process card payments, which make up 22% of the overall Stripe transactions. You can also cater to customers who use SEPA Direct Debit, SOFORT, GiroPay, PayPal, and many others.

For currencies, Stripe edges out 2Checkout. Because while the latter supports 100 currencies, the former has more than 135 currencies.

And like 2Checkout, Stripe can interface with shopping cart solutions. It does so through open-source plugins for Drupal, Magento, WooCommerce, WordPress, Shopware, and many others. It makes its APIs and documentation available for wider integrations as well.

Verdict

Both platforms deliver on cross-border payments. Because of this, there is little that can stop you from taking your business to the international stage. Stripe takes this round, however, because it can process more currencies. If you want to attract a wider audience, you need to let them use the currencies available to them.

2. User-Friendliness

The user-friendliness of a platform is a critical factor in selecting a software. That is because an intuitive system can readily be used by employees sans extensive training. More than that, users can be efficient, as they can access the tools they need easily.

2Checkout

Merchants themselves have reported that 2Checkout is incredibly easy to use. This is good news for business owners and employees who are not too familiar with the technicalities of an online platform, such as coding. In that case, they can connect to third-party software by themselves with little to no help from an IT specialist.

The website itself is pretty easy to navigate, as well. It does not take too much time for users to set up payment options. And for paying customers, the experience at checkout is a seamless one.

Stripe

Stripe is not exactly known for ease-of-use as it requires coding experience to get the most out of the platform. That is because the people behind Stripe designed it for developers. Ease-of-use for the ordinary user can only be seen in its other features.

But when it comes to the experience of the customer, Stripe ensures that transactions are quick.

Verdict

2Checkout takes the trophy in this round. As mentioned above, it is user-friendly even when it comes to integrations because of its plug-and-play approach. The same cannot be said of Stripe, which requires a level of coding skills that only developers have.

3. Fees

In this round, we will talk about the processing fees and any subscription fees for Stripe and 2Checkout. This is a critical section, as this can help you determine which one can help you save more on costs.

2Checkout

2Checkout has four options for enterprise pricing. These all have flat rates so you do not have to worry about changing costs every time. For example, the lowest tier, 2Sell, exacts 3.5% + $0.35 per successful sale. These rates stay the same, regardless of the country you may be operating from.

|

2Sell |

2Subscribe | 2Monetize |

Enterprise |

| 3.5% + $0.35

per successful sale |

4.5% + $0.45

per successful sale |

6.0% + $0.60

per successful sale |

Request a quote |

Stripe

Stripe’s pricing is pretty straightforward. For every successful sale, the platform exacts a fee of 2.9% + $0.30. The software also offers a custom package to accommodate those with unique business models and those who have large volumes of transactions.

|

Integrated |

Customized |

| 2.9% + $0.30 per successful sale |

Request a quote |

Verdict

Stripe takes this round because it has a single transaction rate unless your business arranges a custom plan. This would allow you to focus on growing your operations rather than worrying about fees.

4. Security

The last round of the 2Checkout vs. Stripe comparison delves into the security and privacy measures of the platforms. In this section, we will also talk about their anti-fraud features and tools.

2Checkout

To protect vendors and buyers alike, 2Checkout has dynamic 3D secure. This system is designed to verify the identities of purchasers to ensure that they really own the cards they are using for the transaction. The platform redirects them to their banks, where they undergo a rigorous security process before proceeding.

Additionally, 2Checkout has a payment fraud protection feature. This is a multi-tier strategy with artificial intelligence at its foundation. With this, you can be sure that fraud detection is at its best.

Stripe

Stripe ensures that customers’ card information is under lock and key at all times. To that end, it encrypts data with one of the strongest encryption measures, AES-256. It then stores decryption keys in different machines to prevent easy and illegal access. What’s more, Stripe gives users peace of mind by not sharing info with its primary services.

Furthermore, Stripe is known to comply with various regulations, not just in the US but also in Australia, Canada, and Europe.

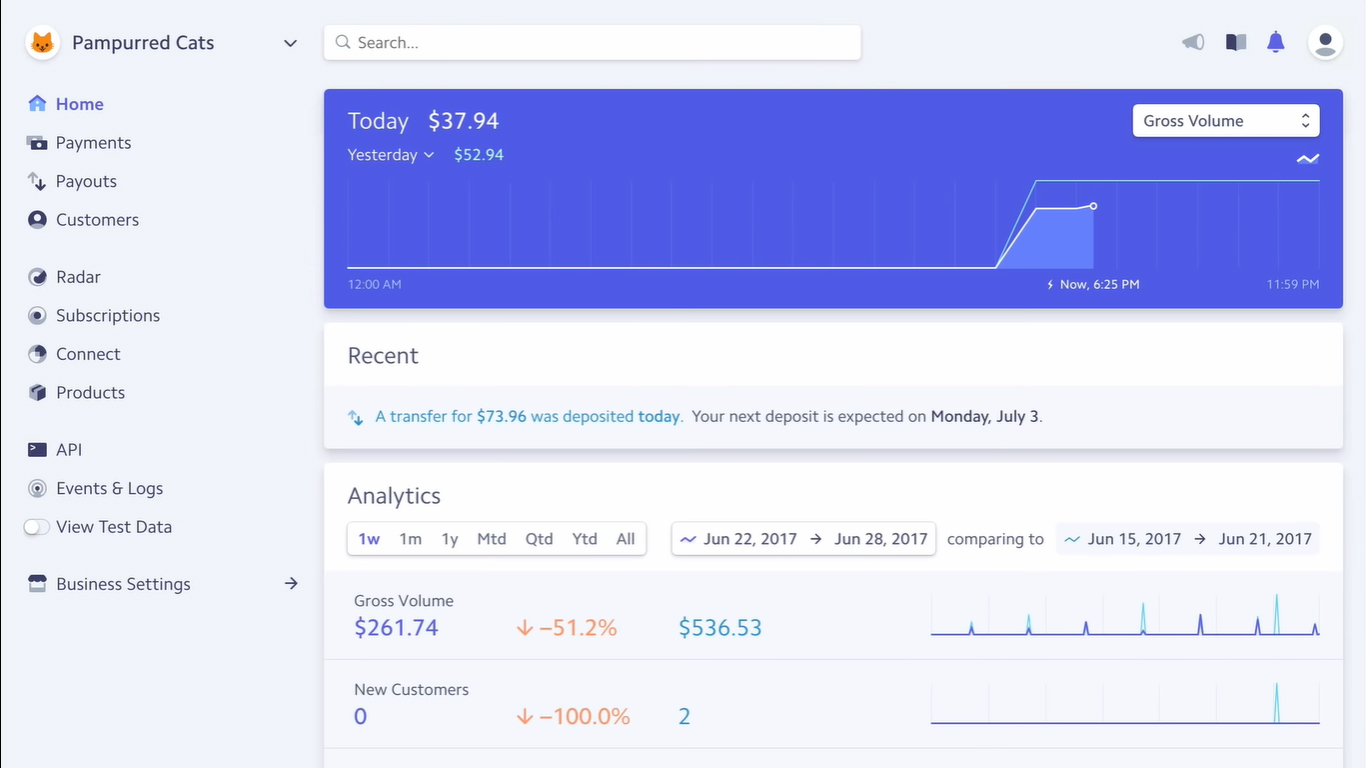

Stripe’s tight security system protects the sensitive information of its users.

Verdict

Both systems do their best to give vendors and buyers the security and privacy they need. But 2Checkout edges Stripe out in this round because its security measures are ready to go as soon as you sign up. With Stripe, you have to configure them because they do not work out-of-the-box. This is actually one of the weak links of Stripe.

The Final Winner

2Checkout bagged more trophies in this 2Checkout vs. Stripe comparison and rightly so. It has flat-rate pricing, making it cost-effective for small businesses. And though it supports fewer currencies than the competition, the number of currencies and payment methods under its belt is nothing to scoff at. What’s more, it has security measures that work out-of-the-box so you do not have to worry about tinkering with its settings.